Genuine Redundancy occurs when employment is terminated because of the below reasons:

-

Company is bankrupt or insolvent;

-

Introduces new technology that replaces someone’s job;

-

Goes through a restructure or merger and acquisition;

-

Relocates interstate or overseas; or

-

Slows down because of lower sales or production.

A dismissal is not a genuine redundancy if the employer:

-

Still needs the employee’s job to be done by someone (for example, hires someone else to do the job);

-

Has not followed relevant requirements to consult with the employees about the redundancy under an award or registered agreement; or

-

Could have reasonably, in the circumstances, given the employee another job within the employer’s business or an associated entity.

Eligibility

Employees are not eligible to receive redundancy pay on various factors include:

-

Less than 12 months continuous service;

-

The employees are employed for a specific period of time or task, or for any specific duration or season;

-

They are working for an employer that employs fewer than 15 employees;

-

The employment of the employees is terminated due to serious misconduct;

-

The employees are casual employees;

-

The employees are trainees or apprentices; or

-

The employees are eligible to other industry-specific redundancy schemes in a modern award.

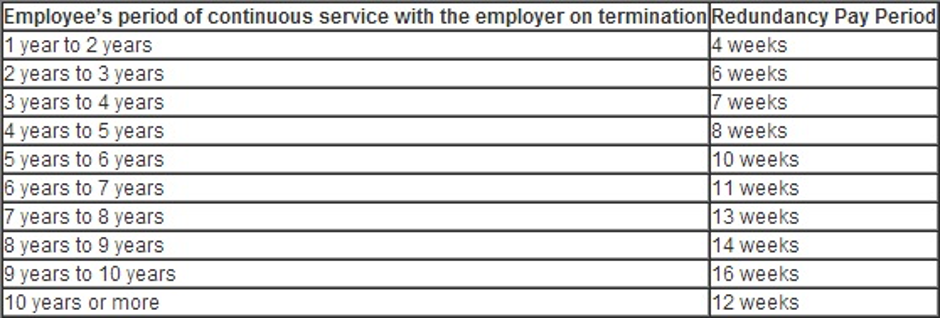

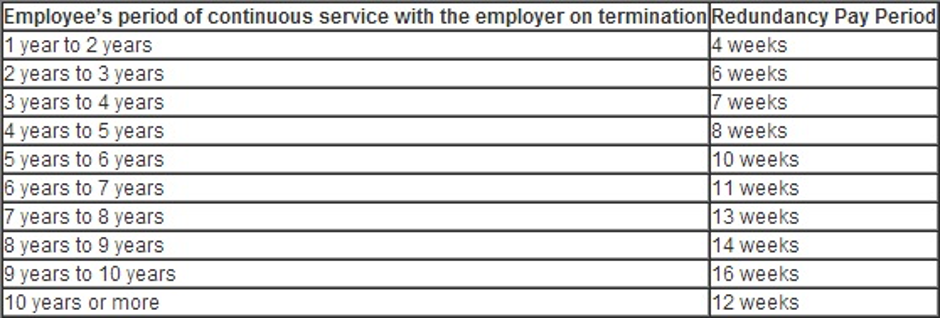

Redundancy Payment Table Australia

The amount of redundancy payable to an employee is determined by using the employee’s base rate of pay for ordinary hours of work. This does not include:

-

Incentive-based payments and bonuses;

-

Loadings;

-

Other monetary allowances;

-

Overtime or penalty rates; and

-

Any other separately identifiable amount.